It’s not easy to get laid off from work especially if the reason of the unemployment is not the fault of the employee.

Many of those who suddenly get terminated not only suffer financially, but also emotionally. And most of the time, it’s not only them who suffer but also their families and dependents.

The sudden loss of income becomes a huge burden especially when there are bills to pay, mouths to feed, students to support, and other financial responsibilities.

Good thing, the Social Security System now has the 7th social benefit which is called the SSS Unemployment Benefit which aims to help ease their financial burden while they’re looking for a new job.

What is SSS Unemployment Benefit?

The SSS unemployment benefit is one of the salient features of SS Act of 2018 which aims to provide a cash benefit equivalent to half of the member’s average monthly salary credit (AMSC) for a maximum of two months.

SSS members who were involuntarily separated from work starting March 5, 2019, onwards can avail the unemployment benefit.

The SSS Unemployment Benefit is also known as unemployment insurance or involuntary separation benefit.

This SSS unemployment insurance is mandated by the newly enacted Republic Act 11199 or Social Security Act of 2018.

What is the Purpose of SSS Unemployment Benefit

The SSS Unemployment Benefit intends to provide SSS members who are involuntarily separated from employment with a temporary source of income to support themselves and their families while they are on the process of finding a new job.

Example:

A member who’s earning P10,000 per month was involuntarily separated from employment.

- The member may be granted cash assistance for a maximum period of two months.

- The cash assistance is equivalent to one half of the member’s AMSC.

- In this case, the member will get P5,000 per month or a total of P10,000 for the two-month period of the member’s unemployment.

Who are Qualified to Apply for SSS Unemployment Benefit Program?

As stated in the SSS Circular No. 2019-011, here are the qualifications of covered employees:

- Age

- Must not be more than 60 years old at the time of involuntary separation. ]

- Underground and surface mineworker, and racehorse jockey members, on the other hand, must not be more than 50 and 55 years old, respectively.

- SSS Contribution

- The member must have paid at least 36 monthly contributions

- With 12 months of these should have been paid within the 18-month period before the month of involuntary separation.

- Reason of Unemployment

- The reason for such separation must not be the fault of the employee or a result of the employee’s negligence which may be caused by the following but not limited to:

- installation of labor-saving devices

- redundancy

- retrenchment

- closure or cessation of operation, and

- disease or illness of the employee whose continued employment is prohibited by law or is prejudicial to his or her co-employees’ health.

- The reason for such separation must not be the fault of the employee or a result of the employee’s negligence which may be caused by the following but not limited to:

- Availees must also, have NO settled unemployment benefit within the last three years prior to the date of involuntary separation.

How Often Can I Avail of this Benefit

A covered employee who is involuntarily separated can only claim unemployment insurance or involuntary separation benefit once every three years starting from the date of involuntary separation.

In the case of concurrence of two or more compensable contingencies within the same compensable period, only the highest benefit shall be paid.

SSS Unemployment Benefit Requirements

Applicants will be required to present and submit

- Documentary requirements such as:

- an original and photocopy of one primary ID card or document or in the absence of which,

- any two ID cards or documents, both with signature and at least one with photo.

- A certification establishing the nature and date of involuntary separation issued by the Department of Labor and Employment (DOLE) through its regional offices or Philippine Overseas Labor Offices (POLO).

- The Notice of Termination from Employer or the Affidavit of Termination of Employment.

How to Apply for SSS Unemployment Benefit

Applicants may file their claims at any SSS branch or foreign office.

Filing for unemployment insurance or involuntary separation benefit claims must be within one year from the date of involuntary separation.

How Can I Claim the Payment for this Benefit

Payments of the unemployment insurance or involuntary separation benefit will be through SSS Unified Multi-Purpose ID (UMID) cards enrolled as ATM or through the Union Bank of the Philippines Quick Card account.

SSS is also currently working to include banks under PESONet and non-bank cash pick-up as other modes of payment for this benefit.

When is this Benefit Effective?

Involuntary separations that occurred on March 5, 2019 onwards are covered by the unemployment insurance.

Update as of October 21, 2019

The Philippine Social Security System (SSS) had already disbursed more than P84 million worth of unemployment benefits in the first two months of implementation of this landmark provision of Republic Act 11199 or the Social Security Act of 2018.

The SSS was able to provide immediate financial assistance to more than 6,900 actively-paying members of SSS who were involuntarily separated from the workforce.

As of 21 October 2019, SSS already paid a total of P84.27 million worth of unemployment benefit to 6,907 members who were separated from work.

Highest Number of SSS Unemployment Benefit Applications:

- Makati Gil-Puyat Branch: 943 applications / P13.76 million benefit paid

- Bacoor Branch: 876 applications/ P8.98 million benefit paid

- Biñan Branch: 833 applications / P9.74 million benefit paid

- Pasig-Pioneer Branch: 437 applications / P6.10 million benefit paid

- Cebu Branch: 437 applications / P6.10 million benefit paid

It’s only been 2 months since the pension fund started receiving applications for the unemployment benefit and the SSS was able to provide cash benefits to the qualified members who needed the SSS the most when they unexpectedly lost their jobs. (Source: SSS website)

Summary of the SSS Unemployment Benefit Program

1. Unemployed SSS Members Can Get Financial Assistance

The new Social Security law states that involuntarily separated employees will receive a cash benefit worth 50% of their average monthly salary credit (MSC).

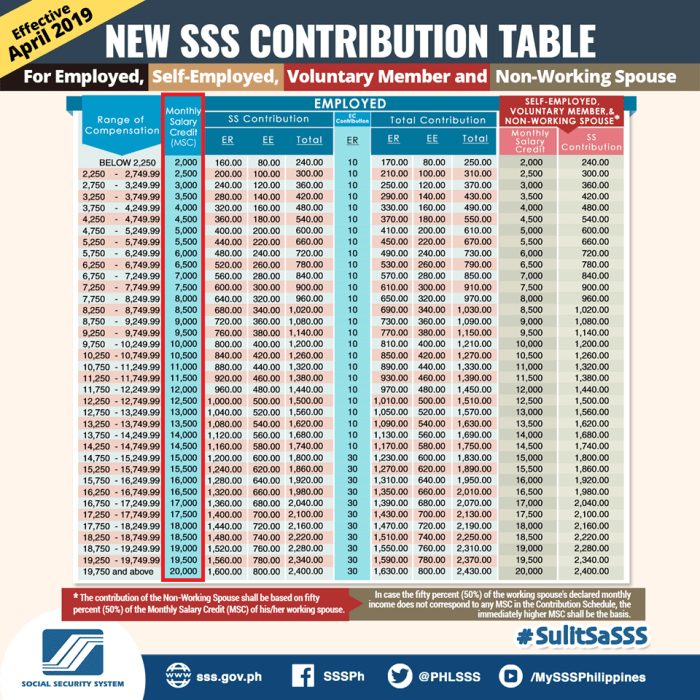

To know your MSC, check the latest SSS contribution table 2019 below.

Find your salary bracket under the leftmost column (Range of Compensation) and see the corresponding MSC in the next column.

2. The SSS Unemployment Insurance is Not a Loan

This new SSS benefit is NOT a loan. This is a new addition to the six existing SSS benefits (sickness, maternity, retirement, disability, death, and funeral benefits) that qualified members can avail.

This means you don’t need to pay the SSS for the financial assistance you will receive.

3. Unemployment Insurance is Good for 2 Months Only

The SSS unemployment benefits last for only two months, which means members can only receive them once every three years. They’re just meant to help you get by while you’re finding a new job.

4. SSS Members Must Meet Eligibility Criteria

The complete list of qualifications are already stated above, but here it is again:

- SSS unemployment benefits can only be given to members who are 60 years old and below.

- Qualified SSS members have paid 36 or more monthly contributions.

- The 12 months of these must be within 18 months immediately before the involuntary unemployment.

You last employer should have consistently remitted your SSS contribution for at least 12 months before your separation from the company so that you can avail of this benefit.

5. This Benefit is NOT for All Unemployed Members

Being unemployed doesn’t mean that you can apply for this Unemployment Benefit.

It depends on how long you have been unemployed, the reason of your unemployment, your SSS contributions among other things.

The law clearly states that only those who are “involuntarily unemployed” are entitled to SSS unemployment benefits. This means the law applies only to those who got laid off from work due to merger, reorganization, or bankruptcy of the employer.

On the other hand, if your unemployment is voluntary—meaning you resigned from work, the SSS won’t give you unemployment benefits.

6. Funding for Unemployment Benefits Will Come From SSS Contribution Hike

If you’re wondering where the SSS will get funding for this new benefit, it is from the increased monthly SSS contribution.

I’m sure you’re already aware that we are now paying higher contributions to the SSS.

Based on RA 11199, the SSS is required to pay unemployment benefits to jobless members.

It is the same law that raises the SSS contribution rate from 11% to 12% in 2019, 13% in 2021, 14% in 2023, and 15% in 2025. Two-thirds of the increase will be shouldered by the employer, while one-third will be deducted from the employee.

So even if it hurts a little bit to see the increased deductions in our salary for our SSS contributions, at least there’s an added benefit which we can avail of when the need arises. (Source: MoneyMax)

Is there also a program like this for Government employees?

Yes. Government employees enjoy unemployment benefits from the GSIS.

So now both private and government employees are now protected from the financial impact of involuntary separation from the service.

RELATED ARTICLES:

Leave a Reply