In 2023, the Social Security System (SSS) Contribution Table has been revised. Effective January 2023, the revised contribution table and new salary bases will take effect.

Employees will now be required to contribute more than before. All employers must adhere to the new SSS Contribution Table for their regular employees.

Failure to do so may lead to penalties from the SSS. Therefore, it is important for employers to remain updated on the changes in the SSS Contribution Table and adjust their payment practices accordingly.

Furthermore, employees may also need to update their salary deductions with their respective employers if they have not been informed of the new table.

For Self-employed and Voluntary members, the new SSS Contribution Table will also be applicable. They have to update their payments based on the table and make sure that they pay their contributions accordingly.

It is recommended for them to create an account with the SSS website for easier tracking of contributions and other transactions.

In addition, the benefits associated with membership in the SSS are also affected by any changes in the contribution table. These benefits include retirement pension, disability, sickness and maternity leave, as well as death benefits. Updates on these benefits can be found in the Official Gazette or from the SSS website.

Finally, employers and employees should both be aware of the new Contribution Table and any other updates so they can take full advantage of the features available through membership in the Social Security System. This will help ensure that employees are properly provided for during times of hardship and retirement.

Additionally, the Social Security System (SSS) also offers various benefits programs for its members, such as the SSS Salary Loan. This program provides financial assistance to an employees’ salary loan needs, allowing them to borrow from their future salaries. To be eligible for this benefit, one must have been a member of the SSS for at least 3 months and have made at least 10 monthly contributions.

Click here for the complete details on the New SSS Contribution Table 2023.

This post is updated today, February 25, 2023.

SSS Contribution Table 2020

Effective April 2019, SSS members shall follow the New SSS Contribution Table 2019.

In accordance with Republic Act No. 11199, or the Social Security Act of 2018, the Social Security System (SSS) issued SSS Circular No. 2019-05 on March 15, 2019, prescribing the new contribution table that is effective in April 2019, as illustrated below.

A. For EMPLOYED MEMBERS

The minimum MSC or Monthly Salary Credit for Regular Employed member is Php 2,000 and the maximum MSC is Php 20,000.

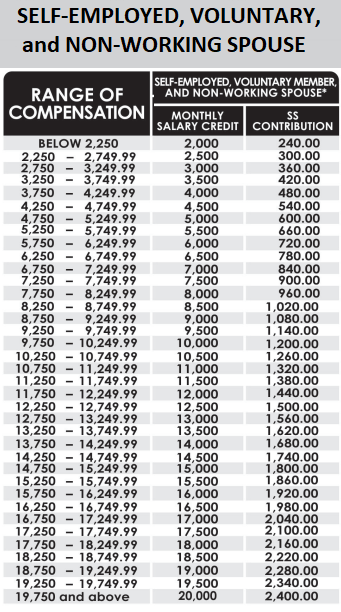

B. For SELF-EMPLOYED, VOLUNTARY MEMBERS, and NON-WORKING SPOUSE

The minimum MSC or Monthly Salary Credit for Self-employed, Voluntary member, and Non-working spouse is Php 2,000, and the maximum MSC is Php 20,000.

The contribution of the Non-working Spouse shall be based on 50% of the MSC of his/her working spouse.

In case the 50% of the working spouse’s declared monthly income does not correspond to any MSC in the Contribution Schedule, the immediately higher MSC shall be the basis.

C. For HOUSEHOLD EMPLOYERS and KASAMBAHAY

Under R.A. No. 10361 or the Domestic Workers Act or the Batas Kasambahay, the employer pays the entire contribution if the kasambahay earns less than Php 5,000 per month.

D. For OFW MEMBERS

The minimum MSC for OFW members is Php 8,000, and the maximum MSC is Php 20,000.

Old SSS Contribution Table 2018

For your SSS contributions until March 2019, you may refer to the old SSS Contribution Table 2018 below.

For Voluntary, Self-Employed, Non-working Spouse, and OFW Members

For Employed Members

The SSS Contribution Table guides you on the amount that you should pay as a member of the SSS.

Your SSS contribution is based on the amount of your salary or compensation.

SSS Payment Deadline for January to June 2019

- Regular Employers – Katapusan ng buwan matapos ang applicable month

- Household Employers – Katapusan ng buwan matapos ang applicable month o quarter, depende sa iskedyul ng pagbabayad

- SE/VM/NWS – Ang mga kontribusyon para sa mga buwan ng January hanggang June 2019 ay maaaring bayaran hanggang 31 July 2019.

Computation of Monthly SSS Contribution

The amount that SSS members remit to the SSS depends on two factors:

- Membership Type

- Employed, kasambahay, self-employed, voluntary, non-working spouse, and OFW members have different contribution amounts.

- Contributions of employees, kasambahays, and certain OFWs are deducted from their monthly salary and remitted to the SSS (along with the employer’s share of contribution) by their respective employers. Others have to pay their entire contribution.

- Monthly Salary Credit (MSC)

- The Social Security Law defines the MSC as “the compensation base for contributions and benefits.”

- The SSS uses the MSC to compute the required contribution for members based on their monthly income.

- The higher your monthly earnings, the higher your MSC is. The higher your MSC, the higher your contribution becomes.

- On the SSS contribution table, you’ll find the MSC that corresponds to your income range.

Benefits of Paying SSS Contribution Regularly

Sometimes, we ask why we need to pay SSS contribution when our salary is just enough or even less to sustain our daily expenses especially if we have a family to feed.

Instead of viewing it as a savings or investment, we think of it as an added expense.

However, you’ll realize its value when the need arises like when you’re sick, injured, laid off, short of cash, or retiring.

One of the benefits of paying SSS contributions is that it forces us to save for the future.

While you’re still earning income, it’s good to build your financial safety net for retirement by paying SSS contribution consistently.

Also, one of the factors that SSS uses as the basis for granting and computing a member’s benefit is the total number and total amount of paid SSS contributions.

The higher you pay for your SSS contribution, the higher your SSS benefits would be.

When you’re an SSS member who regularly pay SSS contribution, you’ll be able to avail of its many benefits.

To qualify for an SSS benefit or loan, members must meet these requirements:

- Salary loan – At least six posted monthly contributions for the last 12 months with at least 36 total posted monthly contributions.

- Sickness/Maternity benefit – At least three posted monthly contributions within 12 months before the semester of sickness, injury, childbirth, or miscarriage.

- Disability benefit – At least one-month posted contribution before the semester of disability.

- Retirement benefit – At least 120 posted monthly contributions before the semester of retirement to receive a monthly pension.

- Death benefit – At least 36 posted monthly contributions before the semester of member’s death, for the beneficiaries to receive a monthly pension.

If you have been an SSS member and you want to know how much you’ve contributed to SSS so far, you may check your SSS contributions online. Click the link below to know how…